The Problems Facing the Financial Industry Today

The banking industry is facing a range of challenges, from outdated legacy systems to complex regulatory requirements and the need to provide a seamless customer experience.

One of the biggest problems today is legacy system modernization. Many banks are still using outdated systems that are difficult to maintain and operate. Banks need to have a strategy for the reconstruction of their systems and processes that will enable them to operate more efficiently and cost-effectively.

With the rise of cyber threats and fraud, banks must have robust security measures in place to protect their customers’ data and assets. Features such as real-time transaction monitoring, fraud detection, and multi-factor authentication help banks to keep their customers’ information secure.

Customer experience is a critical area for banks to focus on to retain a competitive advantage and win the loyalty of their customers. The challenge that the banks are facing in terms of customer experience is the complexity posed by providing personalized services at a scale. With millions of customers and a wide range of products and services, it can be difficult to offer tailored recommendations and solutions for everyone.

Banks must operate efficiently to remain competitive and profitable. One strategic priority needs to be streamlining their operations, reducing manual processes and increasing automation, which would all result in cost savings and improved productivity.

Ventures

Stefanini is a global technology company that offers a wide range of services and solutions across various industries. In the financial sector, Stefanini has established several venture companies that provide innovative and cutting-edge solutions to address the industry’s unique challenges. These companies specialize in areas such as cybersecurity, digital banking, payment processing, etc., and are designed to help financial institutions stay ahead of the curve in an increasingly competitive and rapidly evolving market. With a strong focus on technology and innovation, Stefanini’s venture companies are at the forefront of driving transformation in the financial sector, helping organizations to optimize their operations, enhance their customer experience, and achieve sustainable growth.

Provide an overview of Topaz and its history, as well as the company’s mission and vision

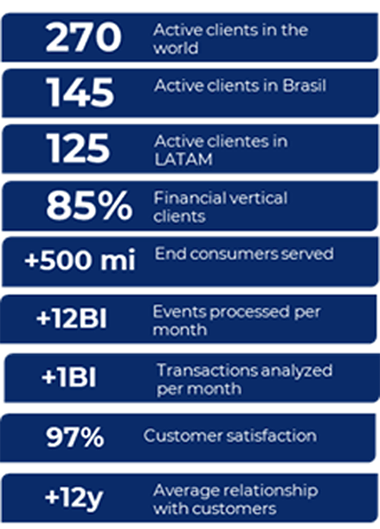

Topaz (part of Stefanini Group) is a software solutions provider that has been making waves in the finance industry with its innovative products and services. Established in 1987, the company has grown significantly over the years, and today it is considered one of the leading providers of software solutions for businesses in Latin America (LATAM) and beyond.

Competitive advantages that set it apart from other software solutions and services providers in the banking industry

- Low-Code/No-Code Platform: Topaz’s solutions are built on a low-code/no-code platform, which enables rapid development and deployment of software solutions. This approach allows banks to quickly implement and scale Topaz’s solutions, reducing time-to-market and improving efficiency.

- Deep Industry Expertise: Topaz has a team of experts with extensive experience in the banking and financial services industry. This expertise enables Topaz to understand the unique needs and challenges of banks and design solutions that meet their specific requirements.

- Customizable Solutions: Topaz offers highly customizable solutions that can be tailored to the needs of individual banks. This flexibility allows banks to implement Topaz’s solutions in a way that aligns with their unique business processes and requirements.

- Global Reach: Topaz has a global presence with offices and clients in North America, Latin America, Europe, and Asia. This global reach allows Topaz to provide support and services to banks operating in multiple geographies.

- Strong Partner Ecosystem: Topaz has built a strong partner ecosystem, working closely with leading technology providers and industry associations to stay at the forefront of innovation in the banking industry. This collaboration enables Topaz to offer cutting-edge solutions that address the latest challenges facing banks.

Topaz offers a range of products and services to help financial institutions modernize their operations and provide more innovative and personalized services to their customers. Here are some of the key products and services offered by Topaz:

Core Banking Solution: Topaz’s Core Banking Solution is a comprehensive platform that enables banks to modernize their core banking systems and streamline their operations, allowing them to provide more efficient and personalized services to their customers.

Digital Banking Suite: Topaz’s Digital Banking Suite includes a range of solutions designed to help banks provide more convenient and personalized services through digital channels, including mobile banking apps, internet banking portals, and digital payments solutions.

Anti-Money Laundering (AML) Solution: Topaz’s AML Solution is designed to help financial institutions comply with regulatory requirements and prevent financial crimes such as money laundering and terrorist financing.

Risk and Compliance Solutions: Topaz offers a range of risk and compliance solutions, including fraud detection and prevention, credit risk management, and regulatory compliance, designed to help financial institutions manage risk and comply with regulatory requirements.

Analytics and Business Intelligence: Topaz offers a range of analytics and business intelligence solutions, designed to help financial institutions analyze customer behavior and preferences, identify new business opportunities, and make more informed business decisions.

Use cases:

With a diverse client base that includes both traditional banks and new digital-only banks, Topaz has built a reputation for trust, sustainability, and flexibility, helping its clients stay ahead of the curve in a rapidly changing financial landscape. Whether it’s modernizing core banking systems, launching new mobile banking apps, or complying with regulatory requirements, Topaz has the expertise and solutions to help financial institutions meet their business objectives and provide a superior customer experience.

PagBank à Client since 2018

- 2nd largest fully digital bank in Brazil with more than 25M clients

- >R$ 1 trillion of financial transactions processed.

- Largest payments acceptance network: 7.3M active merchants

PagBank chose Topaz as a partner to deliver a complete Core Banking solution, which would bring more robustness and scalability to its businesses that have a large volume of transactions, and at the same time boost the security of its processes to reduce costs arising from digital fraud.

Banco de la Nación Argentina à Client since 1991

Banco de la Nación Argentina was looking for a partner that would provide a flexible and robust Core Banking Solution which would support its growth strategy in different regions and countries in Latin America.

With Topaz’s Core banking solution, Banco de La Nación Argentina grew significantly. Today it has 14 branches in 7 countries, each completely adapted to the requirements of its different markets in which it operates, including: Bolivia, Brazil, Chile, Spain, Paraguay and Uruguay.

Outlook and Conclusion

Looking ahead, Topaz has ambitious plans to expand into new markets and industries. The company aims to continue innovating and developing new solutions to help businesses improve their operations and achieve their goals.