When it comes to satisfying consumer needs, the banking and financial services industry is still playing catch-up. And this hesitancy to adapt to the digital world can have a real-world impact on the way financial institutions serve their customers. According to a recent survey, 59 percent of consumers have higher expectations for customer service than they did a year ago, with 80 percent reporting that the experience a company provides is as important as its products and services.

What does this tell us? Now more than ever, financial institutions need to deploy modern technology to deliver improved customer experiences in real time and at a lower cost. For many institutions, this crucial need is difficult to achieve, as it requires both the collection and processing of multiple data sources and the modernization of outdated operating models and legacy systems. One thing is clear – until they modernize their infrastructures, financial institutions will be unable to keep pace with more responsive and innovative competitors.

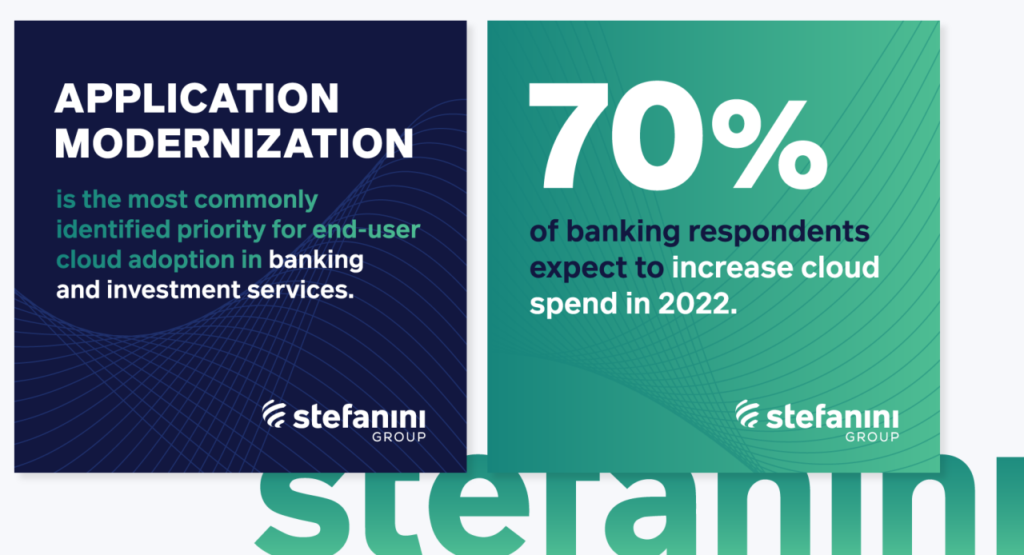

Some institutions are heeding this call, however. According to a recent Gartner report, application modernization is the most commonly identified priority for end-user cloud adoption in banking and investment services. In fact, 70 percent of banking respondents expect to increase cloud spend in 2022.

How can institutions get started? Let’s take a look at the facts.

The Application of Cloud Computing in Banking

Cloud computing is a type of on-demand service that provides access to shared resources, applications, or storage over the Internet. It enables financial institutions to store and process data in remote servers instead of local systems. Cloud computing offers a number of benefits for banks such as increased security, faster processing speeds, and lower costs. While the financial industry has been slow to adopt cloud technology due to concerns about giving up their legacy on-premises applications, regulatory compliance and data privacy issues, this position is starting to change as more financial institutions realize how technology can help them meet their business objectives while satisfying customers’ needs at the same time.

How can your financial institution start building a digital banking strategy? Get tips here!

How Cloud Computing is Used in Banks

Right now, the majority of financial institutions work with external service providers to maintain their cloud, such as cloud management service providers or outsourcing products. Yet, Gartner’s 2021 survey indicated that many banks surveyed expect to reduce working with external service providers and own more of the internal cloud activities within their IT teams. For instance, some companies have established a private cloud in which computing resources are hosted on a network used by only one organization and located within their own data center.

Cloud computing is used in banks for a variety of purposes, including:

- Customer Relationship Management (CRM): Banks use cloud-based CRM systems to manage customer data and interactions. This allows financial institutions to keep track of all customer interactions, regardless of location or time of day. The right cloud strategies also make it easier for banks to provide personalized service based on customer needs and preferences.

- Fraud Detection: Banks use the cloud for fraud detection and prevention by analyzing large amounts of data from multiple sources. This helps financial institutions detect suspicious activity before it causes any damage.

- Data Analysis: Banks are increasingly using the cloud for advanced analytics in order to gain insights into customer behavior patterns and trends. By understanding how customers interact with financial products, banks can create new offerings that meet their needs better than ever before.

6 Benefits of Using Cloud Technologies in the Banking Sector

The following are some crucial advantages that come with using public clouds for banking and financial services:

- Improved customer experience: Banks can provide a better customer experience by offering anytime, anywhere access to banking services.

- Reduced costs: Banks can save money by moving their applications and data to the cloud. The pay-as-you-go pricing model of public clouds makes it more affordable for financial institutions to use these services.

- Faster processing speeds: Cloud platforms are designed for fast performance and can handle large amounts of data quickly and easily. This allows banks to improve their transaction processing speeds and reduce latency problems.

- Greater scalability: Cloud platforms can scale up or down as needed, which gives financial institutions the flexibility they need to best serve their customers.

- Enhanced security: The public cloud is a more secure environment than most on-premises systems, and it offers multiple layers of protection against data breaches and other attacks.

- Compliance with regulations: Banks can meet regulatory compliance requirements by using cloud platforms that are compliant with financial industry regulations.

What is the future of cloud accounting and financial services? Get insights here!

Challenges that Come With Cloud Computing in the Banking Industry

While there are many benefits to using cloud technology in banking, the challenges that come with cloud adoption may be the reason so many financial institutions are lagging behind other industries. According to Forbes, a 2019 survey found that only 18 percent of financial institutions had broadly deployed cloud services. The following are some of the main issues that financial institutions face when moving to the cloud:

- Data privacy and security: Banks need to ensure that their data is safe and secure when it is stored in the cloud. They also need to make sure that their systems conform to any applicable regulations governing data privacy.

- Regulatory compliance: Banks must comply with a variety of financial industry regulations, many of which require specific procedures for handling customer data. It can be difficult for banks to meet all of these requirements when their systems are hosted in the cloud.

- Lack of control: Financial institutions may fear that they will lose some degree of control over their systems when they move them to the cloud.

Risk Management in Cloud Banking Systems

Risk management is an important part of financial institutions’ operations as there are a number of different types of risks that financial institutions face. As McKinsey points out, it is essential for them to manage these risks effectively so they can mitigate their potential negative effects on the bank’s financial performance. The following are some examples of the types of risks institutions face:

- Regulatory risk refers to the possibility that banks may violate certain regulations governing financial services in their jurisdiction or country where they operate. If this occurs, then it could result in fines from regulatory authorities as well as other penalties such as loss of licenses or revocation of charters. This type of risk is especially prevalent when financial institutions use cloud-based systems because those systems might not be compliant with local laws and regulations governing banking activities within a specific jurisdiction or country.

- Reputational risk refers to the possibility that financial institutions may suffer damage due to negative publicity about their services and products in traditional media outlets such as newspapers or magazines.

- Operational risk involves potential financial losses resulting from inadequate internal controls over processes within an organization’s operations; for instance, if proper procedures are not followed when handling customer transactions, then there could be unauthorized access granted by employees who should not have been able to do so (and who expose sensitive data in the process). It also includes risks related to technology failures because these can lead to downtime, which can cause online access problems for customers.

- Strategic risks include any type of change in government regulations that would affect financial institutions’ abilities to operate successfully within a certain market or the exit of a major player from a particular financial market.

The cloud can be an important tool for financial institutions in mitigating various types of risk, but it’s important that they understand the different risks that are specific to their industry and sector. They also need to have robust risk management processes in place so they can quickly identify and react to any potential threats.

The best way for financial institutions to overcome these issues is by making sure that their IT infrastructure conforms with any applicable regulations governing data privacy and security protocols. It also helps if banks have strong internal policies in place to ensure compliance with financial industry laws and regulations.

Partner with Stefanini for Your Cloud Journey

The financial sector has been slow to adopt new technologies in the past, but some financial institutions are now starting to embrace cloud computing as a way of becoming more efficient and effective at serving their customers’ needs. The use of public clouds also allows banks and other financial services firms to deploy applications quickly without having worry about hardware maintenance or software upgrades (which can take weeks or months).

Stefanini is here to serve the financial services industry by taking a customer-first approach to everything we do. By analyzing your pain points and business objectives, we work with you to co-create a solution custom fit for your business. Ready to bring your financial institution into the future and achieve digital transformation? Give us a call to speak with an expert!